For questions, comments or to suggest an innovative corporate leader Please contact :

Editor@

CorporateInnovatorsToWatch.com

Blue Biofuels CEO Ben Slager On the Market For Cellulosic Ethanol And Eco-Friendly Bioplastics

The focus of the Biden Administration on reducing fossil fuel dependence, and transitioning to a green energy platform, creates tremendous opportunities for capital

investment in new and innovative technologies, designed to reduce the carbon footprint that has dominated the energy industry over the past 100 years.

These new technologies, which include electric vehicles, hydrogen and ethanol fuel cell development, biodegradable plastics, and other alternative sources of energy such

as sustainable aviation fuel (SAF), and biodiesel, all have the objective of complying with this new U.S. government mandate for a much cleaner, less toxic, and safer

environment.

One of the companies, at the forefront of this new focus on green-energy technology is Blue Biofuels.

Virtually unknown, at this point, the company is led by a Australian-born CEO by the name of Benjamin Slager.

Mr. Slager, a well-traveled executive, grew up in the Netherlands, and is fluent in English, Dutch and German languages. He

holds a total of over 100 patents worldwide on technologies that he has successfully developed, incubated, and

commercialized around the world.

Blue Biofuels CEO Ben Slager is no stranger to developing groundbreaking technologies. Years ago, as an aspiring entrepreneur, Slager

engineered the development of successful technologies, one in solar power efficiency and the others in the engineering of a lightweight

material that was shown to be 8 times stronger than steel and stronger than Kevlar, and several companies in electronic identification in chip-

cards and other information carriers.

After successfully demonstrating proof-of-concept for these novel technologies, Slager built his upstart little companies into formidable players

in highly competitive industries; eventually selling them to larger companies, on the international stage, that envisioned the mass-market opportunities and uses for the

technologies that Slager had spent years creating.

The first company, Solar Excel BV, developed a technology to significantly increase the efficiency of solar panels by reducing the amount of energy that was being lost

through the adverse reflection of the sun’s rays.

Solar panels that could reduce this intractable effect were able to produce more energy through the absorption of the sun’s rays rather than the reflection of them. This

resulted in less solar-energy loss and reduced inefficiencies.

Solar Excel was acquired by Life Sciences firm DSM in 2013.

The second company, Novameer BV, developed patented high technology fiber products used primarily in the field of impact resistant wearables for antiballistic

applications, using a proprietary webbing technology for the dispersion and absorption of energy.

The development of Brick-laying technology at Novameer contributed significantly to the success of a newly developed high-performance fiber named “Endumax”.

Novameer BV was subsequently acquired by Japanese multi-national company Teijin in 2010.

Further Slager incorporated his first company in the early 1990’s Nedcard BV in which he developed and commercialized the packaging of chips for in chip-cards, this

company grew into Microidentt AG. in which many forms of identification carriers were produced and sold. This company group grew to several hundreds of people and $

100 million revenue under the lead of Slager. Up to the present day every bank card is carrying a chip assembled into a bank or credit card with many technologies as

Slager designed them in the 1990’s.

In 2017 Mr. Slager was appointed to the Board of Directors of Alliance Bioenergy Plus, a company that was working on the development of a unique cellulosic ethanol

technology, which had its beginnings at the prestigious University of Central Florida.

While the process developed at UCF looked promising, Slager realized that some improvements were going to be necessary to scale the technology for commercial

application.

After trying different variations, Mr. Slager finally hit upon the idea which resulted in his new method showing an efficiency rating that was 1500 times greater than what had

come out of the company’s initial prototype testing, which had been based on the process developed at the UCF laboratory.

Mr. Slager, then began the development and bench testing of additional prototypes, using various cellulosic feedstocks and fine-tuning the process along the way. Just

recently, the USPTO awarded a primary patent on his CTS 2.0 technology for converting cellulose to sugar.

This patent approval now paves the way for Blue Biofuels, after years of hard work and development, to begin generating revenues from several potential sources.

Most companies generate their revenues from a single source, typically by selling a product or service in the marketplace in which they compete.

In the case of Blue Biofuels, the company has identified, not one but, three potential sources of revenues stemming from the CTS 2.0 conversion process.

The first source of revenues will come from the sale of sugars, produced by the company’s patented Cellulose-To-Sugar technology. These sugars can then be used to

distill and refine into ethyl alcohol, also known by a more common name --- ethanol.

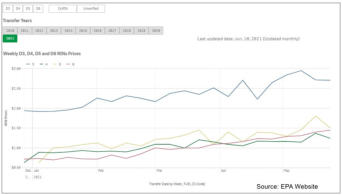

The second source of revenue will be derived from the EPA Renewable Identification Numbers, or RIN credits.

These credits are over and above any profits that are generated by Blue Biofuels from the margins achieved from

the sale of cellulosic sugars. In the past, the D3 RIN credit for cellulosic ethanol has typically been higher than the

D6 RIN credit for corn ethanol.

The third source of revenues is expected to come from a natural by-product of the CTS 2.0 process called lignin,

which can be used to produce biodegradable bioplastics that will organically decompose over time.

Blue Biofuels also holds a license on a technology that converts ethanol into bio jet fuel and bio diesel, an area that

has attracted major attention from alternative energy company GEVO, Inc.

There are very few companies that compete in a space where the U.S. government not only mandates their products

to be used by refiners to blend with gasoline, but also provides financial subsidies to encourage this production and

subsequent blending. These financial subsidies, or RIN credits, carry no overhead costs, and as a result represent

pure profit on top of the existing margins that a company would achieve in its normal course of business.

Ethanol has already become a billion-dollar industry in the U.S and abroad, and a recent report expects the cellulosic ethanol industry to grow at a compound annual growth

rate (CAGR) of 40.5% per year between the years 2021 and 2026.

At the present time, most ethanol production takes place in the midwestern region of the United States and relies on using sugars derived from corn crops.

Unfortunately, the rising price of corn, which is an essential commodity for food and fuel, has escalated to levels which make it difficult for ethanol producers to remain

profitable, as their feedstock costs rise.

Many on Wall Street expect the price of agricultural commodities to continue to increase, as the likelihood of another commodity super cycle appears to be unfolding, along

with elevated expectations for future commodity price inflation.

Cellulosic ethanol, on the other hand, is produced from feedstocks that are both low-cost and abundant and can be found at many municipal solid waste (MSW) sites.

These readily available feedstocks include paper products, cardboard, wood, various types of grasses and plants, along with agricultural material derived from harvesting

various types of crops, such as corn cobs, stalks, and leaves; often referred to as corn stover. This stover typically makes up about one-half of a corn crop which remains in

the field after harvesting the corn.

This is vastly different from corn-ethanol production, which depends primarily on the starches and sugars that are found within the corn kernels. The stover is usually

considered a waste by-product of a corn crop.

The number of ethanol plants in the United States currently stands at over 200. The majority of these, about 98%, are corn-ethanol plants, meaning that the rely on using

corn as the base feedstock for generating the sugars that will ultimately be converted to produce ethanol.

One of the reasons for using corn as feedstock for producing ethanol, lies in the fact that corn is easy to grow with a climate cycle that lends itself to a clearly defined

planting and harvesting season.

Recent changes in weather patterns, which can impact the sustainability of a corn crop, along with increased demand for corn used in processed foods consumed by

human beings, as well as the use of corn to feed various livestock such as cattle, swine and poultry has also led to pressure on corn prices.

There has been a long-standing debate over whether corn crops should be used primarily for food or fuel. As the demand for both uses increase, the price of the underlying

commodity is affected. Higher demand, without an accompanying increase in corn supplies, results in an increased market price.

Corn-ethanol appears to be facing an uncertain future if the trend in rising commodity prices continues along its current path and could possibly cause more corn-based

ethanol producers to consider the use of cellulosic ethanol as an alternative.

In the future, the bioplastics market will likely take on much more importance, as ecological challenges for the disposal of petroleum-based plastics continue. Confronted

with the environmental impact that petroleum-based plastic bottles, straws and other plastic products have on oceans and landfills, a biodegradable alternative offers

ecological advantages, and fits within the socially conscious trend that has developed over the last decade.

Consumers have been at the forefront of this socially conscious movement, as the consequences of using non-degradable plastics have been shown to create harm to the

environment, as well as marine-life, and other animals.

The development of bioplastics, using lignin as the principal material in their production, creates a built-in demand for high quality, virgin lignin. This kind of non-

compromised, lignin becomes even more important when the bioplastic products being produced include items that are used with food and water, such as water containers,

drinking straws, and plastic utensils for eating.

The patented CTS 2.0 process that Blue Biofuels has developed does not use high temperatures, caustic chemicals, or expensive enzymes. This creates a lignin that is

pure and without potentially harmful free radicals that could leech into various plastic products.

On the other hand, the demand for high-quality lignin, used in bioplastics production, is expected to increase substantially, as the Total Addressable Market (TAM) for

biodegradable plastics is projected to achieve a compound annual growth rate (CAGR) of 21.7% over the five year period between 2020-2025.

These two industries, ethanol, and bioplastics are both growing market share exponentially, and are expected to be the focus of Blue Biofuels over the next 3-5 years.

After emerging from Chapter 11 bankruptcy in 2019, with no toxic debt along with a lean and clean balance sheet, the company’s restructuring efforts have resulted in a

uniquely unencumbered status for a micro-cap company.

The company recently raised over $3 million, from investors, to continue with its prototype testing and development. Company management continues to express

confidence in its goal for a 5th generation prototype, which will lead to commercialization of its patented CTS 2.0 technology, by the end of 2021.

If CEO, Ben Slager’s past track record of entrepreneurial successes continues, this company might just be one undiscovered micro-cap stock that investors may find worth

considering.

© CorporateInnovatorsToWatch.com

2021